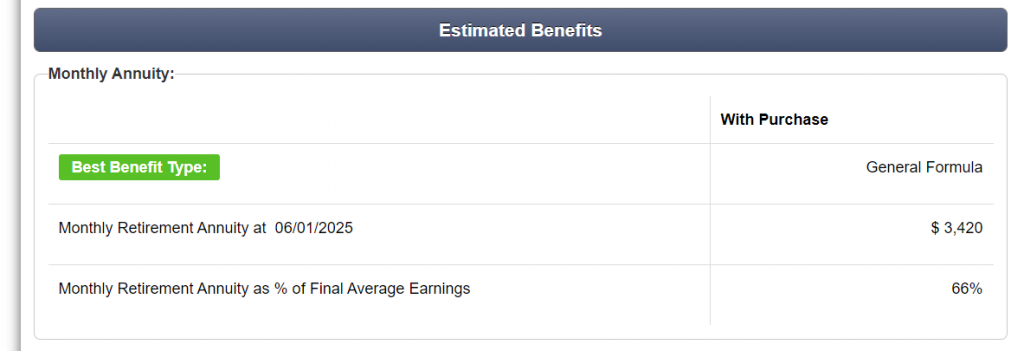

When I look at estimates of my monthly pension (if I were to retire at the earliest possible), I think, “How could I not be able to live on that much?” It seems like $3420 a month would be enough. Multiplied by 12, that’s 41,040 a year.

I currently earn 61,000 a year, and I know how quickly that money goes, so I know I need to do some more thinking before I rely on a pension that offers 20K less.

A look at what I spend a year now could give me some insight. I contribute 1800 a month to my and my husband’s shared account (what we name our family account). That pays for all necessities from cell phone bills to groceries to mortgage payments to hair cuts. I spend more than that each month though.

I choose to pay an extra 420 per month towards the mortgage. I spend about 100 a month on extras from eating out (without the family–eating out with my partner is included in the family account), clothes (if we don’t have enough money in the family account), and I put aside 250 a month for a future car, house projects and personal emergency fund (my husband and I have a shared emergency fund as well). That comes to 770 a month.

We’re currently at 1800 + 770 = 2570.

Now, there are bills I have now that I won’t have when I retire. For example the mortgage will be paid off by the time I retire–woot! Plus, there are projects I want to complete that I will need money for. I’d like to make some larger changes to the house that would cost much more than I’m putting aside now, and if I’m not able to put enough money aside for a large down payment for a car, my monthly payment will be way more than the 150 I am putting aside for the car now. I will also have to pay for health insurance when I cease working for my employer. In short, the 770 a month I pay beyond my main bills is not likely to be the amount I will need in the future, but looking at my current spending is 1 way of looking at retirement, so I’m going to use it.

It looks like I spend about 2570 a month, which is 30,840 a year. If I’ll receive 3420 a month and 41,040 a year, I should be good, right?

Maybe. I would be grossing 3420 a month, so I need to account for taxes. I also have a ton of other money taken out of my paycheck now such as insurance, money that goes into the retirement system. I wonder if I’ll have any of those taken out. I won’t be in the union anymore when I retire, so I won’t have to pay dues. In short, I hope all these little fees are no longer deducted from my gross pay.

Let’s get back to income tax. Say I pay 400 a month for taxes, which is what is taken out of my current paychecks. That would be 3020 a month. Even if I deduct that from what I would gross a month on retirement, that’s still about 500 more than what I currently spend.

From these calculations and my current living situation, it looks like it is possible to live of my pension alone.

I know I need to do many more calculations and lots more thinking in order to be comfortable actually considering an early retirement. Here’s my place to start though, and that is very exciting.

What am I forgetting? Feel free to add questions or thoughts in the comments below!

Peace Out (and In),

Julie

2 COMMENTS

Anne

4 years agoHi Julie,

I wonder about your investments. Would you continue to make contributions to those once you retire from work?

Do you think you might work part time? That would also add to your income if you retire.

Julie

4 years ago AUTHORThank you for your questions, Anne! There’s so much I still need to think about.

The only investing I currently do is in my work-related 403b and I hope not to touch that until at least normal retirement age.

I also hope to save some funds before my optional retirement so that I start another investment account. I have pretty limited discretionalry income that is not already designated to go somewhere else, so that may be pretty limited.

One main challenge I have is that I want to be sure to save all I can without feeling like I am depriving myself. I have been frugal to a point when I was denying myself things I could afford and I think I suffered because of it.

Over the years, I have realized that I still want to work after I retire from my full-time job, so yes, I hope to work part time.. I may even work a more full-time schedule if I am happy hobbling together some different roles. ~ Julie