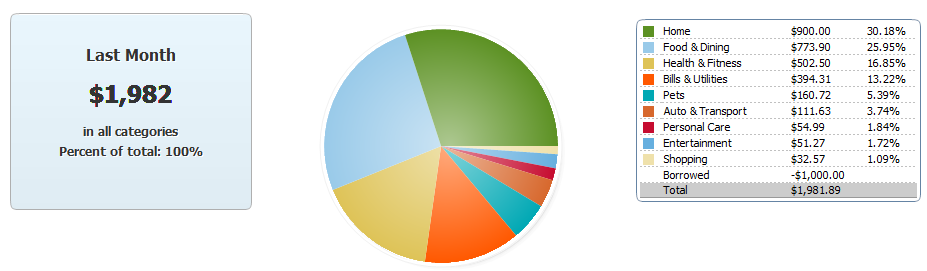

Alright. Here’s what Quicken says we’ve spent. My significant other paid 1000 back to the shared account, so technically, we spent 2, 982 this month.

Let’s break it down. The 900 under “home” is mortgage. Let’s look at a breakdown of “food and dining.”

Wow, so that is about 600 for groceries and about 175 for eating out. To me, 175 doesn’t seem high for eating out. We spend 20 to 30 if we go out to eat just the 2 of us, and we spend about 50 if we have the kids. It could be that we went out twice with the kids about 4 times on our own, or it could be that we went out just once with the kids and 6 times on our own. If necessary, I can look at our checking account.

For now, though, moving onto health. We spent about 500 after paying our insurance, so these are for copays, my monthly message, meds if I remember to put them over to “health” instead of “groceries” (which is where the land since I get them at the grocery store).

I’m sure my 55 a month message apt is in “doctor.” Let me see if I can add up our copays. Most weeks I have 1 apt, so that is 80, our shared counseling is 1 apt a week as well so that’s another 80, then my significant other is going to physical therapy and just has had a psychiatrist apt, etc, so let’s say 2 apts for week which is 160 a month. Does that add up? The 160 + 80 + 80 is 320, and we have my message in there, so the 357 makes sense, and the dentist, pharmacy and gym are self-explanatory.

The next section is bills. I snipped the actual bill amounts since we just have 5 bills in this section.

If we wanted to, we could determine if any of these individual bills are more than we want to pay.

Next up is pets.

This is no mystery either . . . our pet food and 1 apt came up to about 160. I don’t think I’ll break down the other sections of expenses since they are about 100 or less.

In short, I think it may be worthwhile to look at our spending on food, and hope that some months we’ll have fewer apts so we’ll spend less on “health.”

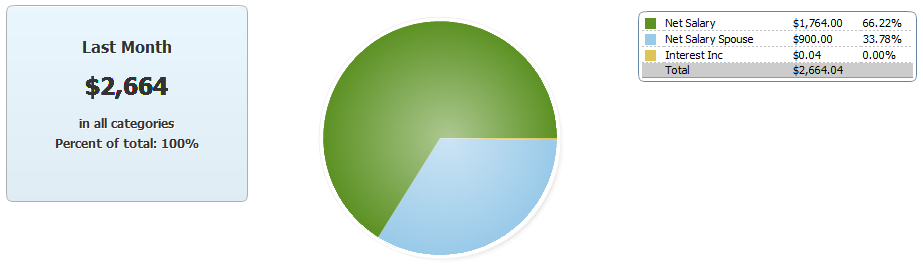

Our other issue this month is deposits. We deposited about 300 less than we spent. Usually we’d have a 180 deposit come in during the month, but there were 2 deposits of this in Sept, I’m guessing because of when a weekend landed. If we had that 180 during this month, we’d be down more last month, BUT that would mean we only overspent about 120, which is a lot better than it could be.

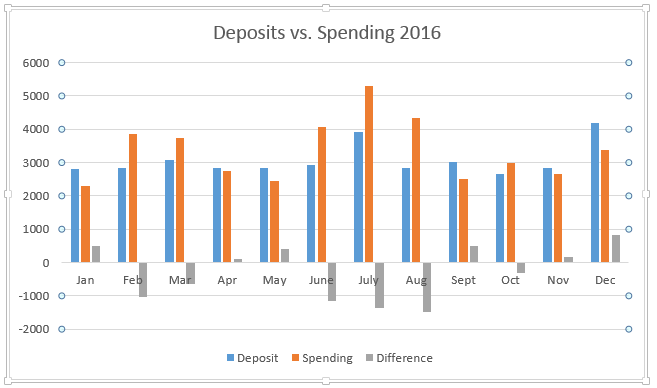

My next step is to compare this October to October 2015 through the year long graph I created (and am not re-creating since I lost it–oops!) More numbers await!

Leave a Comment