A few years ago, I estimated how much money I spend per year to see if I could retire early. I found out I could! I’ve learned recently though, as documented in Perceptions of Finances Part 1 and 2, that my estimates and reality can be quite different. I’ve got to track and calcluate what I spend to figure out how much I need to live how I want.

I recently calcluated how much my husband and I spend on living expenses per year ($49,000) and thus, how much I need to contribute per year ($24,500).

My next step is to figure out how much money I spend out of my personal account. (My husband and I keep separate accounts for hobbies, eating out with friends, and projects.)

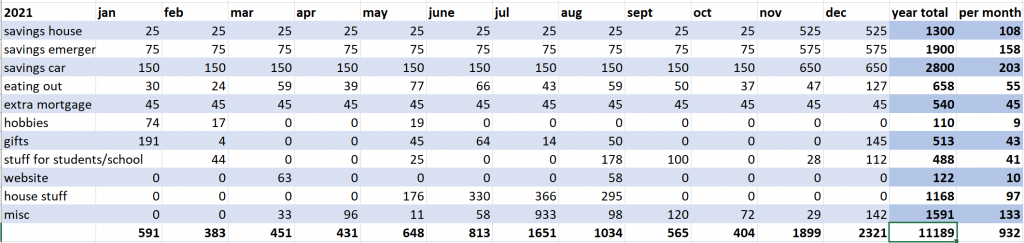

I chose to break down my personal spending by category.

The first 3 lines show how much I put aside in 2021 for house projects ($1300), my emergency fund ($1900), and for a car ($2800). That money isn’t spent yet, but the intention is to spend it, so I am comfortable designating it as “money spent” last year. I am trying to grow these accounts, so when I spent money on “house stuff” ($1168) last year, I took it out of my checking instead of the “house projects” fund. I bought a 9 foot x 12 foot rug for my front room, and I put in a raised garden last year, so that’s what the $1168 went into.

I spent about $660 eating out, which is about $55 a month. I pay $45 extra a month towards the mortgage out of my personal account. Another $400 extra comes out of what my husband reimburses me for his health insurance, which comes right out of my paycheck. (My employer pays for 45% of his insurance premium and they take 55% from my checks.) So I put $445 extra a month towards our mortgage; I am super excited about making progress towards that.

My next category is “hobbies” and my main hobby is knitting. I spent just $110 this year on yarn and needles. I’m guessing that most years I spend more. I have a ton of yarn, though, and I got bags of yarn from a friend who moved out of town this year.

The last category I want to make note of is the one I labeled “stuff for students/school.” I want to feel free to buy my students donuts or pizza whenever. I also know my school won’t pay for certain supplies–or it’ll take forever to get them, so I buy cardstock, notecards, and highlighters when I want them. Hence, I buy these things from my personal money.

The grand total is $11,189 for the year, so that’s $932 per month. Once again, this is much more than I would have thought I spent.

If I add the money I spend on living expenses $24,500 and how much I spend from my personal account (let’s round to $11,200), I spend $35,700 a year.

Correction: that’s how much I spent in 2021. I’ll need to keep track of my spending for the next few years to have a better idea of what I’ll need in retirement. I’ll also want to make sure my retirement plan covers my health insurace, though the cost of my husband’s insurance will increase (since we currently pay just 55% of the premium cost).

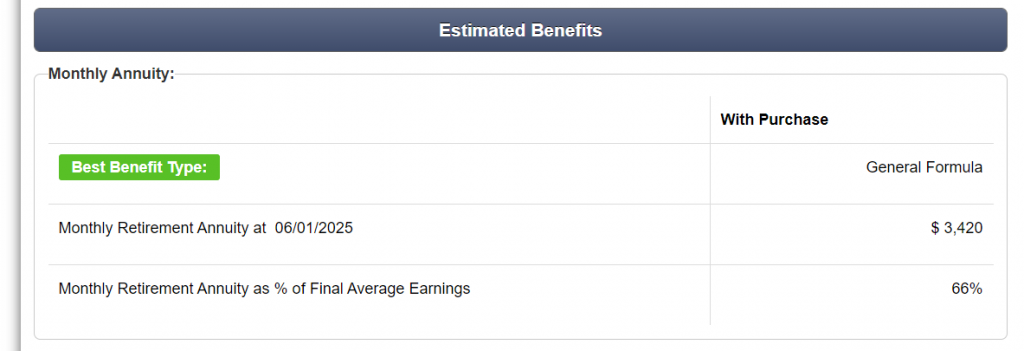

To determine if my pension will cover $35,700 a year, I used my retirement company’s retirement calculator. Again, I need to be cautious because the calculator is just an estimate.

The calcluator shows that I should receive 66% of my current income (actually, it’s an average of my 4 highest years). That’s $3420 a month, which is $41,040. Yup, 41K is more than 35K, but wait, I’ll still need to pay taxes, right? I think my husband and I are in the 12% tax bracket, so that’s about $5K. $41K – $5K = $36K

If I spend $35,700, I would just have $300 left that year. Wow, that is way too close for comfort. A car payment could easily blow that out of the water.

Does this mean I cannot retire in 2025? Heck no. For me it means I need to continue to work in retirement, which sounds like not-retirement, but I’ve already figured out that I want to continue to work. I want lots more choice, though, on how and where and for how many hours a week I work. I also may choose not to retire from my full-time employment in 3 years–a lot can happen in that time.

For now I love this plan and I’ll keep working towards it.

Peace Out (and In),

Julie

Leave a Comment

Pingback: Mortgage Pay Off // A New Plan – Peace Out and In on March 16, 2022

5 COMMENTS

Joan

2 years agoWow, great job getting on top of your finances.

Julie

2 years ago AUTHORThanks, Joan! It took a long time, but I’m glad I did it!

Julie

JMFL

2 years agoTaking taxes into account really changes things. I can see where my own past finances struggled because I didn’t factor that into account. Thanks for the update.

Julie

2 years ago AUTHORYup!