I’m pretty excited that the fed cut student loan interest to 0% right now. I’m not really sure why I’m excited, though, because my partner and I don’t plan paying the loan off–ever.

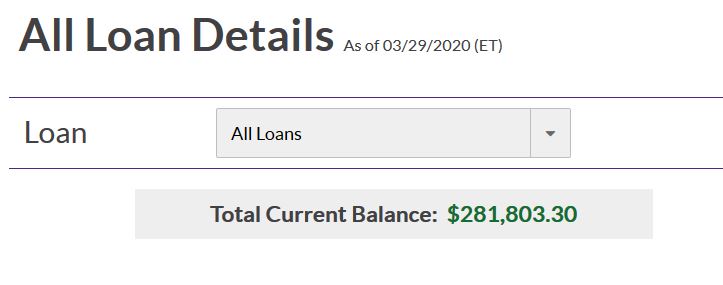

We’re on an IBR plan with forgiveness at the end. At that point we’ll need to claim the forgiven amount as income on our taxes. In terms of how much we owe (over 281K), this small amount of time without loan interest (a few months?), I can’t imagine it’ll make any difference in the end.

It’s still nice not to see the numbers go up daily. Yes, daily. Even with a $750 payment per month, we still accrue about $45 interest daily. At $45 a day times 30 days is $1350, minus the 750 payment a month and what is left is 600. So our loan goes up about 600 a month. Depressing, huh?

______________________________________________________________________________

______________________________________________________________________________

I think I’m still excited, though, because looking at the amount of the loan go down instead of up, even for 1-2 months if that’s all it lasts, may make me think about the loan differently. Maybe I’ll figure out a way we can actually pay off the loan. Maybe the government will see how valuable it is for people to have lower interest rates (I can dream, right?) Or maybe that little bit of inspiration will help make the 750 payments less painful.

I don’t know, but I make a payment on April 3, so we shall see.

Peace Out (and in),

Julie

Leave a Comment

Pingback: Student Loan Repayment Plan – Peace Out and In on March 29, 2020

1 COMMENT